Best Average Life Insurance 2022 Rates, Review & Cost

f you’re looking for life insurance, there are dozens of companies, term lengths and coverage amounts to choose from. Price will no doubt factor into your decision and may even determine what type of policy you choose. For a snapshot of those prices, Nerd Wallet compared average life insurance rates for men and women at different ages and health tiers, across multiple coverage options.

Life insurance companies mostly base their rates on your age and health status, but they also factor in your job, your weight, whether you smoke and even your family health history. Unlike other kinds of insurance, life insurance quotes aren’t affected by your location. Compare rates for a variety of policy types and Best Average Life Insurance 2022 Rates, Review & Cost .

Average Life Insurance

The average cost of life insurance is $27 a month. This is based on data provided by Quotacy for a 40-year-old buying a 20-year, $500,000 term life policy, which is the most common term length and amount sold. But life insurance rates can vary dramatically among applicants, insurers and Best Average Life Insurance 2022 Rates, Review & Cost .

Life Insurance Cost

Life insurance rates are determined by several factors, including your age, gender, health, whether you’re a smoker, the type of policy you buy and the amount of coverage you want. Buying a policy when you are young is one of the best ways to keep your life insurance costs low.

How life insurance rates are determined

Life insurance premiums are primarily based on life expectancy. In general, the younger and healthier you are, the lower your premium.

Insurers typically categorize applicants using terms such as Super Preferred, Preferred and Standard, where the super preference is the health category. The insurers then calculate the premium based on your risk class.

Each insurer has its own evaluation process and weighs different factors. For this reason it is a good idea to compare quotes from multiple insurers.

These are the main things insurers evaluate when setting your rates:

Your age. Generally, young people pay less for life insurance. This is because as you get older, your life expectancy decreases and your insurer’s chances of paying off your policy increase. So it is wise to buy life insurance as soon as possible; The longer you wait, the higher your rate will be based on age.

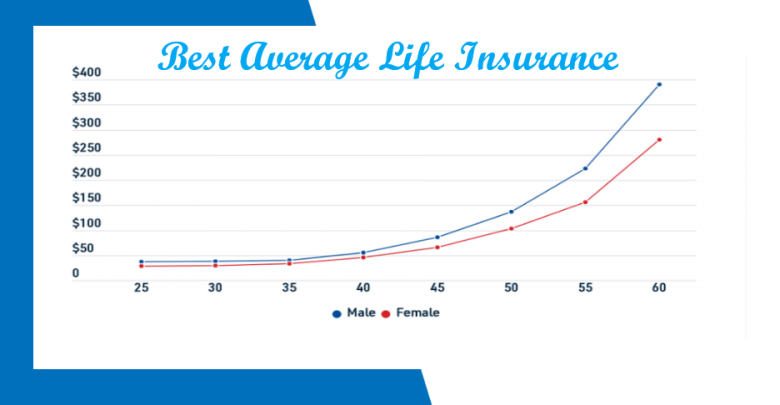

Your gender. Since women have longevity, women almost always pay less than men of the same age and health. According to the latest data from the Center for Disease Control and Prevention, life expectancy in the United States is 79.9 years for women and 74.2 years for men.

[1]

.

The state of your smoking. Because smokers have a higher risk of developing health problems such as respiratory illnesses, life insurance for smokers tends to be more expensive.

Your health. This includes any pre-existing conditions as well as your blood pressure and cholesterol levels. Insurers will also look at your height and weight.

Your family medical history. Your insurer may ask if you have a family history of serious health conditions such as heart disease, cancer or diabetes.

Your driving record. If your record contains DUI, DWI, and major traffic violations, your insurer may consider you a high-risk life insurance applicant and charge you a higher rate.

Your profession and lifestyle. If you have a dangerous or high-risk job, such as a police officer working in a bomb squad or a race car driver, you can expect a higher salary than anyone with a desk job. Similarly, if you engage in risky activities such as skydiving, you may be charged a higher premium.

Average Cost Life Insurance Age

Monthly life insurance premiums remained steady entering the new year, according to Policy genius data, with a minimal increase from December 2021 to January 2022. Life insurance costs are lowest for young policyholders with low health risks, while rates tend to rise with a policyholder’s age. For example, it costs $25.56 per month to insure a healthy 35-year-old woman with a 20-year term life insurance policy worth $500,000. That same policy would cost $152.23 monthly for a 55-year-old man in good health.

Term Rates 30 Year Old Female

Term Rates 40 Year Old Male

Term Rates 30 Year Old Female

Term Rates 50 Year Old Male

Term Rates 50 Year Old Female

Term Rates 60 Year Old Male

Term Rates 60 Year Old Female

Term Rates 30 Year Old Male

Term Rates 70 Year Old Female

How are Calculated

The monthly cost of life insurance depends on a policyholder’s life expectancy. Life insurance companies take a number of factors into account, such as age, sex, health, medical history and even recreational hobbies. Consumers who are riskier to insure should expect to pay higher monthly premiums.

While low-risk policyholders will cost less to insure. To determine your health risk, life insurers may require you to undergo a medical exam. Health conditions like high blood pressure or obesity can factor into the overall cost of a life insurance policy. Policies

With term life insurance, you can customize your policy by choosing how much coverage to buy, the term length (how long you want the coverage to last), and if you want to purchase any add-on benefits, called riders. The policy you choose will affect its cost. A $5,000,000 policy will cost more than a $500,000 policy.

One that provides coverage for 40 years will cost more than one that lasts 10 years. Coverage options range from $50,000 to millions. Term lengths vary from 10 to 40 years.

Determined Insurance Rates

Life insurance premiums are based primarily on life expectancy. In general, the younger and healthier you are, the cheaper your premiums.

Insurers typically classify applicants using terms like super preferred, preferred and standard, with super preferred being the healthiest category. Insurers then calculate premiums based on your risk class.

Each insurer has its own evaluation process and weighs factors differently. That’s why it’s a good idea to compare quotes from multiple insurers.

These are the main things insurers assess when setting your rate:

-

- Height and weight: If your height and weight are within the certain limits, you’ll receive better rates than if you’re deemed overweight or underweight, both of which could cause health problems.

- Past and current health: How healthy you are significantly affects your rates. Pre-existing conditions are taken into account to determine if they will decrease your life expectancy.

- Family health history (siblings and parents): If your family medical history shows serious illnesses, especially hereditary diseases, you could be saddled with higher quotes.

-

- Nicotine and/or marijuana use: Smokers, other nicotine users (including vaping and the patch) and marijuana users have a higher risk of developing cancer and respiratory diseases, so they’ll be quoted higher rates.

- History of substance abuse: Abusing drugs or alcohol can lower your life expectancy, resulting in higher life insurance rates.

- Driving record (particularly DUIs and speeding tickets): Driving under the influence, driving at high rates of speed and/or causing accidents makes you a higher risk and results in increased rates.

- Credit: Credit is a factor in some risk scores that life insurers use.

- Criminal history: Having a felony on your record can impact your ability to get a policy. Even if you can buy a policy, a felony will generally increase your costs, especially if you’ve served time as your life expectancy has likely declined.

Your age. Generally, younger people pay less for life insurance. This is because as you age, your life expectancy goes down, and the likelihood of your insurer having to pay out your policy goes up.

# Best Average Life Insurance 2022 Rates, Review & Cost